Mining industry against free Govt shares

Written by on May 5, 2024

The Chamber of Mines of Namibia (CoM) has raised concern over a government proposal to obtain free shares in mining companies.

The idea is known in the extractive sector as ‘mandatory free-carry shareholding’.

The chamber’s chief executive, Veston Malango, says the proposal would undermine the economic viability of existing mines and future projects if not handled properly.

Malango told the CoM’s annual general meeting in Windhoek last week that minister of mines and energy Tom Alweendo’s recent announcement stirred negative sentiments on investment in local and international circles.

He said free-carry shareholding involves that the government obtains shares in mines without paying for them.

“This would cost the mines, and we will be engaging the minister over the issue to discuss the proposal,” Malango said, adding that the minister did not indicate what percentage of shareholding the government would want.

Alweendo announced the government’s intention in the National Assembly on 1 March last year.

He reiterated this policy position during a workshop organised by the parliamentary standing committee on natural resources at Swakopmund in June 2023.

Malango said the chamber took proactive measures to allay concerns, crafting a strategic engagement plan while advocating clarity on government’s position.

To allay these fears, he said the government is still deliberating on the free-carry policy.

“It will not be implemented without further clarity, consultation and adherence to the necessary legislative procedures,” he said.

Malango said the chamber has crafted a strategy to guide its engagement with the ministry on free-carry shareholding, which it intends to pursue once it has obtained clarity and details regarding its implementation.

He said the chamber engaged Alweendo and key officials from the mines ministry in February 2023 through a workshop on the draft minerals bill, following its release in 2022.

“The primary aim of the workshop was to discuss the chamber’s detailed submission on the bill, and to achieve alignment on key issues with the ministry,” Malango said.

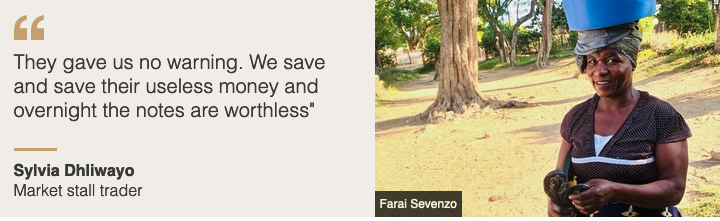

Veston Malango

He said the most contentious aspects of the draft bill include proposals to raise the upper royalty rate limit from 5% to 10% for base and precious metals, nuclear fuel minerals, dimension stone and industrial minerals, the introduction of a windfall corporate tax, and the incorporation of mining charter provisions in legislation.

The CoM believes the royalty and tax proposals in Namibia’s mining industry are currently among the highest in the world, and research indicates that further tax increases could render projects and mines in Namibia economically unfeasible.

The chamber scored a major victory with the withdrawal of the proposal in the Road Fund Administration (RFA) bill, which aimed to eliminate the fuel levy refund system which had been unresolved for over four years.

“This accomplishment effectively averted the potential burden of substantial operational costs to mining companies, which would have been triggered if the proposed amendment to the RFA bill had been implemented,” Malango said.

He said the chamber and the ministry are still in the process of reconciling their positions on these matters, as well as addressing various follow-up items stemming from the workshop.

Their aim is to conclude consultations on the draft minerals bill this year, which comes after more than 20 years of review, moving towards its implementation and the finalisation of associated regulations.

Asked for comment yesterday, deputy mines minister Kornelia Shilunga said while this is still just a proposal, it is driven by the need to benefit Namibians.

She said the ministry would host workshops in all 14 regions of the country to get stakeholders’ input on the policy.

“This is in line with the local content initiative and Namibians should benefit from their resources. That is why we are consulting on the policy proposal,” Shilunga said.

– email: [email protected]

The post Mining industry against free Govt shares appeared first on The Namibian.